Asia Pacific holds the greatest opportunity for biogas

Biogas and biomethane offer a sustainable source of local energy. Producers convert organic residues and wastes into clean energy that can be used for power, heating or as a clean alternative to the solid biomass used in cooking in many developing countries. These products present a myriad of benefits including lower emissions, improved waste management and greater resource efficiency.

Multiple production pathways and a diversity of feedstocks means every region of the world has the potential to produce biogas and biomethane. Yet the fuels account for only 3% of total bioenergy demand and a meagre 0.3% share of total primary energy.

35 million tonnes of oil equivalent (Mtoe) of biogas and biomethane was produced in 2018. A recent World Energy Outlook Special Report, released by the International Energy Agency (IEA) in March 2020, suggests current utilisation rates are only a fraction of their potential. The Outlook for Biogas and Biomethane estimates 600 Mtoe of biogas could be produced sustainably today, enough to satisfy 20% of worldwide gas demand. IEA foresees strong prospects for biogas and biomethane with the growing interest in renewable energy and the transformation of the global energy system.

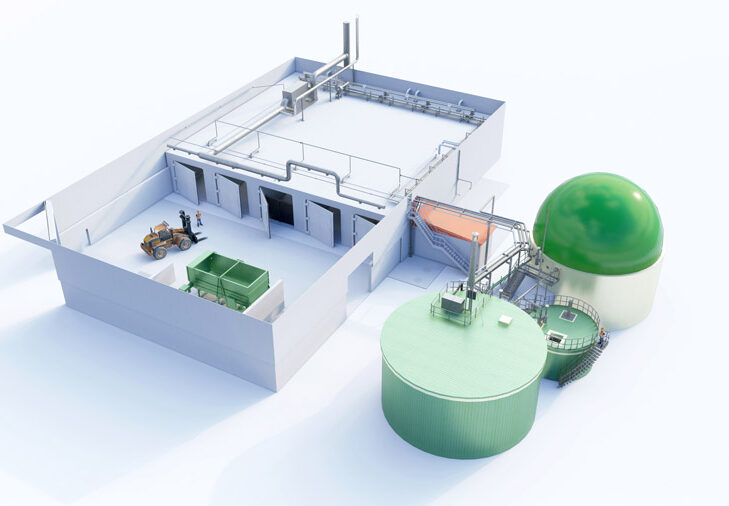

Biogas, a mixture of methane, carbon dioxide (CO2) and small quantities of other gases, is generated through the breakdown of organic matter by anaerobic bacteria in an oxygen-free environment. 90% of biomethane is produced by upgrading biogas to remove CO2 and other impurities. Once upgraded, biomethane delivers all the energy benefits of natural gas, minus the associated net emissions.

According to the IEA outlook, Asia Pacific holds the greatest opportunities for biogas and biomethane due to rising natural gas consumption and imports. The report also emphasises opportunities in North and South America, Europe, and Africa.

Biogas feedstocks include crop residues, animal manure, municipal solid waste and wastewater. Animal manure and crop residues are the most commonly used feedstock, the latter accounting for half of the global potential for biogas. Forestry residues can also be used in the direct production of biomethane via the alternative gasification process. The use of specific energy crops plays a considerable role in some regions of the world, though the practice remains the source of vigorous debate over land use impacts.

According to the IEA, Europe, the United States and China account for 90% of global biogas production. Developing countries in Asia, such as India and Thailand, generate half of the remaining production.

Despite untapped potential in the Asia Pacific, Germany is the global leader. Two-thirds of Europe’s capacity and the majority of the region’s 20,000 biogas plants are located in the Federal Republic. In China, policies aimed at increasing access to modern energy and clean cooking fuels have encouraged the installation of household-scale digesters to produce biogas in rural locations. Landfill gas collection is the primary method for biogas collection (90% of production) in the U.S.

Most of the biogas produced today is used in the power sector with only a very small share converted to biomethane. Europe and North America produce the bulk of the 3.5 Mtoe worldwide biomethane output. Interest in biomethane is increasing due to the ability to use existing infrastructure for this clean energy source.

Germany, Italy, the Netherlands and the United Kingdom have all provided policy support for biomethane in transport. Upgrading biogas “could be a major source of future growth,” the IEA report suggests. The agency predicts biomethane production facilities will exceed 1,000 in 2020, including both biogas upgrading and biomass gasification facilities.

The IEA outlook presents two distinct scenarios for the growth of biogas and biomethane to 2040. A Stated Policies Scenario (STEPS) is built on current and announced energy and climate policies. An alternative Sustainable Development Scenario (SDS) assumes attainment of various energy-related sustainability goals, in accordance with the Paris Agreement, and calculates a feasible pathway to achieving them.

In both STEPS and SDS, biogas and biomethane are the fastest growing form of bioenergy over the next two decades. Today’s market share is a combined 5%. The outlook projects demand will reach 12% by 2040 in STEPS, and 20% in SDS — due to its emergence as a viable complement to low-carbon electricity. In STEPS, biogas production for direct consumption doubles, reaching around 75 Mtoe in 2040. Biomethane avoids around 1,000 million tonnes (Mt) of GHG emissions in 2040 in SDS.

High production costs continue to be a handbrake to the adoption of many sources of bioenergy. Biogas production costs vary wildly today, between USD2/MBtu (million British thermal units) and USD20/MBtu, with a notable regional variance. The report expects biogas production costs to drop slightly over time. A simultaneous increase in natural gas pricing should create a more favourable production environment. Under STEPS, an estimated 260 Mtoe of biogas could be produced for less than prevailing regional natural gas prices in 2040. Monetising production by-products, such as “digestate” — a residue of fluids and fibrous materials that can be sold as a natural fertiliser, may also enable a more cost-competitive production environment.

The cost gap between biomethane and natural gas is also expected to narrow. The outlook predicts global production costs will be 25% lower than today, at USD14/MBtu. Still, there are commercially viable opportunities for biomethane in certain regions today. IEA estimates 30 Mtoe of biomethane could be produced at present for less than the domestic price of natural gas — equating to 1% of total gas demand.

Despite advocating a positive growth story, the level of growth will be shaped by policy support and feedstock availability, the agency says. The outlook indicates feedstock availability should grow by 40% to 2040, but also caveats the impact of more sophisticated and sustainable waste management practices that could reroute feedstock away from certain biogas production technologies.

Read this story on F+L Magazine Digital Edition.

echo '