Marine diesel engines: The beginning of the end?

The Sulzer Brothers foundry was established in 1834 by Johann Jakob Sulzer-Neuffert and his two sons. In 1898, Sulzer constructed its first diesel engine, part of a cooperation with German inventor and mechanical engineer Rudolf Diesel. Six years later, the company installed its first diesel engine in a ship, a freight boat named ‘Venoge’.

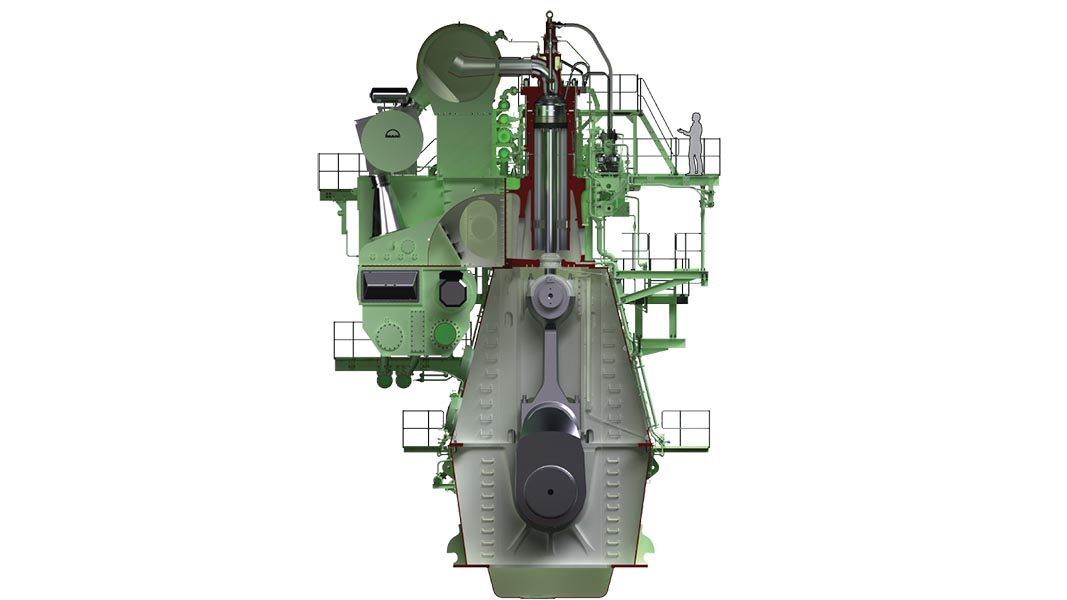

The relative efficiency of diesel engines compared with the incumbent steam turbine meant marine diesel engines were quickly adopted by ocean goers. Now, many years after the mysterious death of Rudolf Diesel on the evening of September 29, 1913, the majority of internal combustion engines utilised in ships are diesel.

Some analysts are beginning to question whether we are witnessing the beginning of the end of the marine diesel engine. Despite being one of the lowest greenhouse gas (GHG) emitting sources of mass cargo transportation, there has been a palpable shift in public and regulatory pressure to act to reduce emissions in the marine industry.

Shipping is one of the hardest sectors to decarbonise. During the virtual SIBCON 2020 bunker event, held on October 6-8, 2020, a panel of marine industry experts indicated that the international shipping sector expects to achieve International Maritime Organization (IMO) emissions targets for 2030. The 2050 ambitions are considered far more challenging. Conflicting dialogue around dual targets of 1.50C and 20C of warming is creating additional confusion.

Environmental interests and price are driving attention to alternative fuels as a replacement for conventional petroleum-based ship fuels. Are we simply witnessing a transition in fuels or a step-change in convertors akin to the historical move from oar to sail?

Panellists at the SIBCON Deep Dive on Alternative Fuels – Evaluating Options offered divergent opinions on the role of the diesel engine and decarbonisation of the shipping industry. Tomas Tronstad, managing director at Norwegian hydrogen technology company Hyon, suggests it may not be the end of the diesel internal combustion engine, but concedes its dominant role will diminish amongst a myriad of technology solutions.

Diesel engines are not solely capable of running on diesel fuel, but rely on the diesel cycle for combustion of the fuel. Deepak Devendrappa, director, global market development at Methanex, foresees a long shelf life for the modern diesel engine due to its ability to burn many types of fuel and the availability of an increasingly diverse variety of fuel choices in dual fuel mode. Perhaps it will be called a modern marine engine, rather than a marine diesel engine, he surmises.

Jacob Sterling, head of technical innovation at integrated logistics company A.P. Moller – Maersk, predicts the next generation of marine fuel engines will comprise of fewer single fuel engines and a lot more dual fuel. They will likely run on ammonia or alcohols, with diesel fuel as a backup. Vice President, Maritime and Supply Chain Excellence at BHP, Rashpal Bhatti, agrees with the assertion that engine types are going to be different. The BHP representative anticipates a shift from homogeneity to heterogeneity. We will see a significant number of fuels being used in the upcoming years until the market will naturally converge towards an economic and emissions centric set of fuels, he says.

The SIBCON panellists emphasised the challenges of decarbonising the marine industry — environmental compatibility, the availability of sufficient fuel, fuel costs and international rule setting. Pressure to act quickly throws an additional spanner in the works. The shipping sector is one where long-term market-tested solutions are necessary. A very substantial investment in ships is occurring now, which may have a lifespan of several decades. A diverse range of solutions will be required to achieve zero emissions, there is not going to be a one-size-fits-all solution for shipping. At this point, we can’t rule out any options.

When the recent IMO low sulphur regulations were confirmed for January 1, 2020, many industry analysts expected heavy fuel oil (HFO) to remain the foremost bunker fuel through the application of scrubber and exhaust gas recirculation solutions. However, Very Low Sulphur Fuel Oil (VLSFO) is dominating bunker fuel supply in 2020. There has also been a slight increase (approximately 10%) in the consumption of marine gasoil (MGO). HFO accounts for around 20% of total fuel oil consumption.

Several emerging technologies harbour potential for shipping applications including battery systems, fuel cell systems and wind-assisted propulsion. Fuel cells are still in their infancy and are unlikely to replace the main engines in ships for some time, and wind-assisted propulsion, which some experts suggest could play a role in reducing fuel consumption, remains a difficult business case. The development of battery technology offers considerable potential in some shipping applications, although at present its role is limited to efficiency and flexibility enhancement.

Speaking at the CIMAC web seminar on Defossilisation of shipping, on October 27, 2020, Christoph Rofka, head of Global Product Group Medium, Low Speed and Rail at ABB Turbocharging, Switzerland, and chair of the CIMAC GHG strategy group, suggested that the fuel switch remains the biggest lever available to the marine industry. Though, without binding measures it will be difficult to motivate investments. Rofka reiterated that IMO must adopt binding measures until 2023 to phase-in net zero and zero carbon fuels. CIMAC is a global non-profit association of the Internal Combustion Engines Industry with representation in 27 Countries in America, Asia, and Europe.

What are the fuels that can allow us to fully decarbonise shipping and how can we get enough of it? According to DNV GL, an advisor to the maritime industry, the number of realistic candidates is limited. LNG, LPG, methanol, biofuel, and hydrogen appear to be the most promising candidates.

Of all the relevant and economic alternative fuel choices, LNG produces the lowest carbon dioxide (CO2) emissions. BHP is the world’s first company to put out an LNG-fuelled Newcastlemax bulk carrier tender. Eastern Pacific Shipping (EPS) was recently awarded a five-year time charter contract for five LNG-fuelled Newcastlemax bulk carriers — to carry iron ore between Western Australia and China. An “overwhelming” 25 organisations responded to the tender, many with multiple offers. This tells you the industry understands and has bought into a 30% reduction in the carbon footprint, says Bhatti.

The release of unburned methane, the so-called methane slip, is getting a lot of attention, with some experts suggesting it may negate the benefit of LNG over HFO and MGO due to the higher GHG impact of methane versus CO2. BHP only utilises high-pressure engines, with the lowest amount of methane slip, says Bhatti. There are clear technology drivers that can minimise the amount of methane slip, he says.

Oil and gas are out, says Sterling. These fuels may work as an intermediate solution, but they will not get us to zero, he says. The A.P. Moller – Maersk representative believes future fuels will come from biomass, renewable energy in the form of electricity, or a combination. Carbon capture on ships will not work, due to the considerable storage implications, says Sterling.

Considering biomass, Sterling suggests biodiesel offers relatively low CO2 reduction potential. It is a good starting point, but it is not scalable or sustainable at the quantities required. It is important to distinguish between biodiesel and biomass. We need to consider other types of sustainable biomass, such as biomass residues, he says. 30% of wood content is lignum. We believe we can develop a way to blend these into alcohols, either methanol or ethanol, offering a lower price and improved technical quality of fuels, he says.

On renewable energy, green ammonia and green methanol are the strongest candidates, he says. Ammonia is promising, as the chimney does not emit any CO2, and ammonia offers advantages in short-sea and deep-sea operation. Though, toxicity challenges need to be resolved, says Sterling.

The biggest advantage of methanol is it is easily scalable — infrastructure exists and engine technologies are well-known, and methanol is easy to handle, compared to ammonia. However, methanol requires carbon capture to be truly neutral, says Sterling.

Green hydrogen, produced by electrolysis, has advantages for low-powered ships in the near sea, such as short-distance passenger ferries. Hydrogen plants are also highly scalable. The very low energy density of hydrogen does create challenges in storage and needs to be either pressurised or compressed. Compressed hydrogen typically requires separate cryogenic tanks or containerised solutions. At present, A.P. Moller – Maersk does not see hydrogen as a viable fuel solution for their ships, says Sterling. Hydrogen, of course, is extremely important as is the first step to make methanol and ammonia, he says. One of the biggest challenges in the creation of new renewable fuels is the scaling of wind and solar power.

Most alternative fuels come with a cost premium, including a penalty on size compared to diesel due to storage implications. How can we open the door to cost reduction of new marine fuels? A future carbon tax may assist alternative fuels in becoming competitive. However, the SIBCON 2020 panellists also emphasized the need for the shipping industry to understand additional markets that they do not understand today. Previously, the marine industry has focused on understanding the oil and gas markets, with many companies dedicating entire departments to the pursuit. Now, the sector needs to understand new and complex markets, such as agriculture and power, with a great number of individual dependencies.